Votorantim: a permanently capitalized investment holding company, with a long-term investment approach, that seeks to deliver superior financial returns with positive social and environmental impacts.

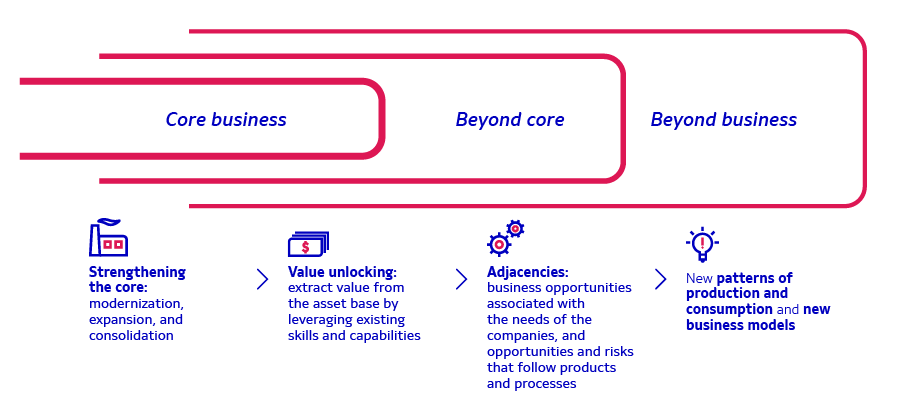

The essence of Votorantim’s management mandate includes achieving the investment objectives of its shareholders, acting in accordance with the pillars of its DNA, and complying with internal financial and dividend policies. Under these guidelines, the investment approach considers macro-themes that apply both to existing businesses and new investments: (i) strengthening the core business through investments in modernization, expansion and consolidation; (ii) extracting greater value from the asset base by leveraging existing skills and capabilities; (iii) operating in business adjacencies, assessing opportunities and risks related to products and processes; and (iv) paying close attention to new production and consumption patterns and business models that can present new opportunities and mitigate risks.

Votorantim continues to be focused on having a diversified portfolio of assets, from a geographic, industry and risk perspective. In line with this strategy, a series of impactful initiatives were implemented in 2021, such as:

All capital allocation decisions are tested against adverse scenarios and are based on the organization’s ability to face challenges, considering the qualification of its teams and of an adequate capital structure. This diversified and careful approach, combined with the courage to invest in the future, places Votorantim among the few Brazilian companies that have an investment grade rating by the three main credit rating agencies.

Patient capital, nonnegotiable purpose

In Companies

Capital structure that allows for growth and dividends

Preserving the capacity to invest: sustaining, modernization and expansion

Perpetuate the Votorantim DNA

Foster innovation to transform the business model

In the Portfolio

Financial and strategic flexibility for large scale investments

Diversification:

Delivering on the investment objectives of our shareholders

For Shareholders

Maximizing total shareholder return (TSR)

Long-term sustainability of Votorantim

GRI 102‑12 | 102‑18 | 102‑26 | 102‑27 | 102‑29 | 102‑32

Votorantim’s ESG agenda is guided by the continuous promotion of ESG themes as the company maintains its commitment to transparency, improves the quality of the information it discloses, and adapts its report to global methodologies to standardize ESG indicators. The year 2021 marks the 11th publication of the annual report according to the guidelines of the Global Reporting Initiative (GRI).

During 2021 Votorantim continued to evolve in the ESG agenda and in its role as an engaged investor, with special progress at the holding level where emphasis was placed on the topics of investment decisions and engagement with strategic stakeholders.

According to corporate governance principles, each of the portfolio companies has autonomy to manage ESG issues, in line with its business strategies. In this context, Votorantim has three key ESG-related objectives:

Votorantim became the first Latin American member of Focusing Capital on the Long Term (FCLT), a nonprofit organization that develops studies, research, and tools to drive the creation of long-term value. The company is joining more than 70 investors and world-leading companies in this initiative.

Votorantim also joined the Entrepreneurs for the Climate initiative, led by the Brazilian Business Council for Sustainable Development (CEBDS, for its initials in Portuguese), with the goal of moving, together with other participating companies, toward a low carbon economy. Some of the portfolio companies, such as Votorantim Cimentos, CBA, and Nexa, also joined the initiative.

Progress in this area was also made at Altre, which structured its corporate governance and created its Board of Directors with two independent members; at Votorantim Cimentos and Votorantim Energia, which each of created their Sustainability Commissions; at Citrosuco, which created its ESG Committee and at banco BV and also Citrosuco, both of which became signatories of the UN Global Compact, an initiative that promotes fundamental and internationally accepted values in the areas of human rights, labor relations, the environment, and the fight against corruption. The holding company is also part of the Global Compact’s Anti-corruption Call to Action.

Influence portfolio companies to adopt environmental, social, and governance best practices, contributing to the long-term sustainability of the business.

Follow the incorporation of ESG criteria into decisions regarding new investments and in the evaluation of the portfolio companies, while also monitoring social, environmental, governance, and reputation risks from Votorantim’s perspective. Votorantim.

Communicate transparently and consistently about ESG initiatives undertaken by Votorantim and the portfolio companies.

GRI 102‑15 I 102‑21 I 102‑40 | 102‑42 | 102‑43 | 102‑44 | 102‑46

The content of this report is based on the materiality matrix developed by Votorantim in 2018. The stakeholder consultation process included the analysis of documents from Votorantim and the portfolio companies in addition to interviews with internal executives and corporate leaders of the portfolio companies, sustainability professionals, finance specialists, academics, and national and international investors. The data collected and the needs identified were analyzed and informed the definition of high-interest topics, in two categories, to be included in the matrix: (i) topics material to both the holding company and the portfolio companies, and (ii) topics specific to each company depending on the nature of each business.

In 2019, the company conducted a study on environmental, social, and governance demands from financial stakeholders. The work was based on the evaluation of the methodologies used in the main sustainability index and by ESG assessment consultants, and considered initiatives such as CDP (Carbon Disclosure Project) and the Task Force on Climate-Related Financial Disclosures (TCFD), which engages companies with the goal of creating a common standard for the assessment, measurement, and disclosure of financial risks related to climate change. The integration of these topics with the company’s materiality resulted in the prioritization of issues that are addressed by the investment strategy, communications with stakeholders, and the disclosures of indicators in the annual report.

Votorantim also developed a study on the Sustainable Development Goals (SDGs). Learn about the company’s material topics and their correlation with the United Nations SDGs.

Material for Votorantim and the portfolio campanies GRI 102-47

Specifc topics of the portfolio campanies GRI 102-47