GRI 102-7

The meaningful increase in vaccination rates resulted in the relaxation of restrictions related to the pandemic, thus providing a resumption of economic activity. In sync with the recovery of the global economy, all portfolio companies had positive results, which contributed to historic consolidated results for Votorantim.

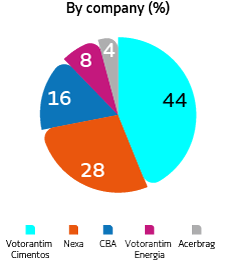

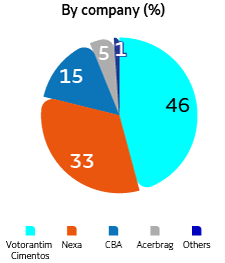

In the consolidated view, Votorantim’s results consider the operations of Votorantim Cimentos, CBA, Votorantim Energia, Nexa, Acerbrag, and Altre. The results of banco BV and Citrosuco are reported according to the equity method.

Year-end consolidated net revenue was R$49 billion, 39% higher than in 2020. The growth was primarily driven by better operating results linked to price and sales volume in the cement, metals and mining, and aluminum businesses.

Votorantim Cimentos had higher sales volume in all regions where it operates and positive price dynamics, especially in Brazil. Nexa also benefited from the positive effect of a higher sales volume, combined with the positive effect of metal prices in reais. At CBA, the results were driven by the higher price of aluminum.

In the consolidated view, Votorantim’s results consider the operations of Votorantim Cimentos, CBA, Votorantim Energia, Nexa, Acerbrag, and Altre. The results of banco BV and Citrosuco are reported according to the equity method.

Year-end consolidated net revenue was R$49 billion, 39% higher than in 2020. The growth was primarily driven by better operating results linked to price and sales volume in the cement, metals and mining, and aluminum businesses.

Votorantim Cimentos had higher sales volume in all regions where it operates and positive price dynamics, especially in Brazil. Nexa also benefited from the positive effect of a higher sales volume, combined with the positive effect of metal prices in reais. At CBA, the results were driven by the higher price of aluminum.

Consolidated adjusted EBITDA totaled R$11.5 billion, an increase of 70% compared with 2020, and was the highest result obtained by Votorantim in its entire history.

Votorantim ended the year with consolidated net income of R$7.1 billion, compared with a net loss of R$3.1 billion in 2020. The company also benefited from the positive effect of R$4.4 billion related to the recognition of a 15% interest in the long steel business of ArcelorMittal Brasil S.A. In compliance with accounting rules, this interest is recognized as a financial instrument measured at fair value through profit or loss.

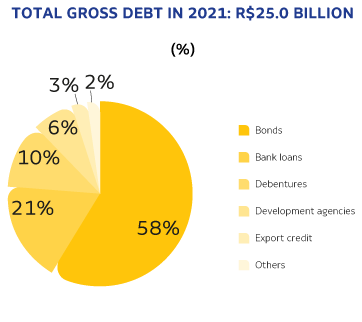

At the end of 2021, gross debt totaled R$25.0 billion, remaining stable in relation to 2020. Cash, cash equivalents, and financial investments totaled R$16.7 billion, of which 33% are in reais.

In September, Votorantim ended its US$200 million revolving credit line. On the same day, Votorantim Cimentos and CBA concluded negotiations for two new revolving credit lines (US$250 million for Votorantim Cimentos and US$100 million for CBA). These credit lines, both maturing in 2026 and not yet disbursed, strengthened Votorantim’s consolidated liquidity position, which totaled R$18.7 billion in December 2021.

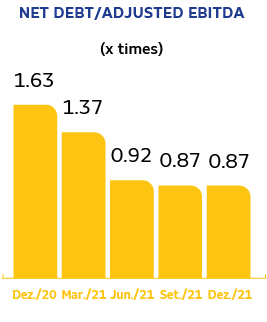

Year-end net debt was R$10 billion, 12% lower than in December 2020, and financial leverage, measured by the net debt to adjusted EBITDA ratio, was 0.87x, the lowest since 2008.

As a consequence of these exceptional results, in 2021, Moody’s upgraded Votorantim’s rating from Ba1 to Baa3 with a stable outlook, highlighting the diversified portfolio and cost-competitive operations of the portfolio companies in addition to a positive scenario for the sectors in which the company operates. Thanks to that, the holding company became part of a select group of Brazilian companies with an investment grade rating by the three main global credit rating agencies: Moody’s, S&P Global Ratings, and Fitch Ratings.

The high level of transparency that marks Votorantim’s relationship with investors, analysts, and creditors—in line with that of publicly traded companies—was also highlighted by the agencies.

To communicate with investors and analysts, Votorantim maintains a dedicated space on its Investor Relations website, which includes, among other information, operating and financial results and market announcements.